The selection of the bare tax return, or the extended tax return with everything is made during the Save-to-PDF process.Īnd back those PDFs up to a backup USB or CD.every year we get tons of folks begging for access to a tax return on a crashed disk.TTX doesn't have it.only you do when you use the desktop software. That has yet to be determined.ġ) Once as the tax return for filing (this contains just the filing tax forms)Ģ) Again as the tax return, but with ALL the forms and worksheets (this contains all of your worksheets and shows all of your entries on some form or another).

Those can always be at least read by any system, even if they can't be used directly by the program.Įspecially.if you are upgrading to Windows 10.there is no guarantee that any of the 2014.or prior year tax programs will run at all on W-10. Then on the new computer copy the folder (or files) from the flash drive to your Documents folder. Then copy that folder to a flash drive or best yet is to burn it to a CD or DVD and then you will have a backup of them. What I would do is just copy the whole Turbo Tax folder that is under your Documents.

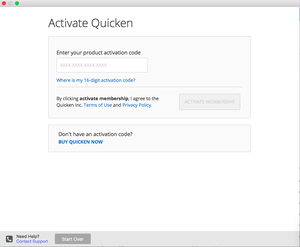

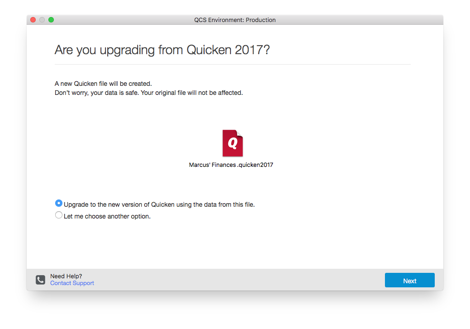

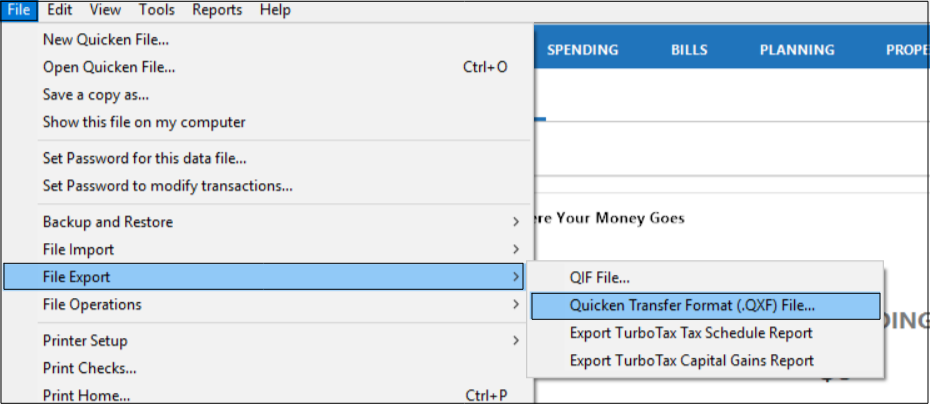

So you may want to open each year and do that. Convert from Quicken Windows to Quicken Mac in one click (excludes version from Mac App Store) Do it all right from your Mac (no Windows required) Easily import data from Quicken Mac 2015, Quicken Mac 2007, and Quicken Essentials with just one click Export Category Summary and Tax Summary reports to a CSV file: Export these reports with a.

Convert quicken windows to mac pdf#

Before you move your tax return files make sure you have saved each year as a PDF file. You don't need to install the prior year programs unless you need to amend that year.

They have to be installed from the CD or Download.

0 kommentar(er)

0 kommentar(er)